The Basic Principles Of Hsmb Advisory Llc

The Basic Principles Of Hsmb Advisory Llc

Blog Article

See This Report about Hsmb Advisory Llc

Table of ContentsAll about Hsmb Advisory LlcGet This Report on Hsmb Advisory LlcThe Best Guide To Hsmb Advisory LlcThe Main Principles Of Hsmb Advisory Llc 4 Simple Techniques For Hsmb Advisory LlcSee This Report on Hsmb Advisory Llc

Ford states to steer clear of "cash money worth or long-term" life insurance policy, which is even more of an investment than an insurance. "Those are extremely complicated, come with high compensations, and 9 out of 10 people do not need them. They're oversold due to the fact that insurance coverage representatives make the biggest compensations on these," he claims.

Impairment insurance can be pricey. And for those who choose for long-lasting treatment insurance coverage, this policy might make handicap insurance coverage unnecessary. Find out more concerning long-lasting care insurance policy and whether it's best for you in the next area. Long-term treatment insurance policy can assist pay for expenses connected with lasting care as we age.

The Of Hsmb Advisory Llc

If you have a persistent wellness concern, this kind of insurance might wind up being crucial (St Petersburg, FL Life Insurance). Nevertheless, don't allow it worry you or your checking account early in lifeit's usually best to get a policy in your 50s or 60s with the anticipation that you will not be using it till your 70s or later on.

If you're a small-business owner, consider shielding your source of income by acquiring company insurance coverage. In the event of a disaster-related closure or duration of rebuilding, company insurance can cover your revenue loss. Think about if a significant climate event affected your store or manufacturing facilityhow would certainly that impact your revenue?

Plus, making use of insurance coverage could sometimes cost more than it saves in the lengthy run. For instance, if you obtain a chip in your windshield, you might think about covering the repair service expenditure with your emergency savings rather than your vehicle insurance coverage. Why? Since using your car insurance can cause your monthly costs to increase.

The Main Principles Of Hsmb Advisory Llc

Share these pointers to safeguard enjoyed ones from being both underinsured and overinsuredand seek advice from a relied on professional when needed. (https://www.avitop.com/cs/members/hsmbadvisory.aspx)

Insurance coverage that is purchased by a specific for single-person insurance coverage or protection of a family. The individual pays the costs, rather than employer-based medical insurance where the employer usually pays a share of the costs. People may look for and acquisition insurance coverage from any kind of strategies offered in the person's geographic region.

People and family members may qualify for financial support to decrease the price of insurance coverage premiums and out-of-pocket costs, but just when enlisting through Link for Health Colorado. If you experience specific adjustments in your life,, you are qualified for a 60-day duration of time where you can enlist in a specific strategy, even if it is outside of the annual open registration duration of Nov.

15.

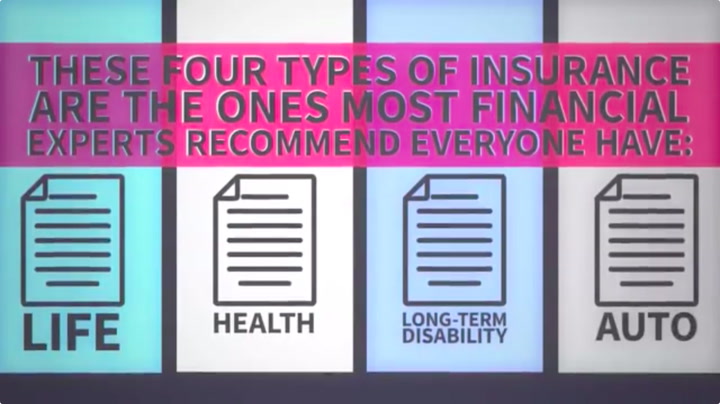

It may seem easy but comprehending insurance coverage types can also be confusing. Much of this confusion originates from the insurance coverage sector's recurring goal to develop tailored protection for insurance policy holders. In making adaptable policies, there are a selection to pick fromand all of those insurance policy types can make it challenging to understand what a specific plan is and does.

Facts About Hsmb Advisory Llc Revealed

The very best location to begin is to chat about the difference between both types of fundamental life insurance policy: term life insurance policy and permanent life insurance policy. Term life insurance policy is life insurance that is just energetic for a while period. If you pass away during this period, the individual or people you've called as beneficiaries may obtain the cash payout of the policy.

Several term life insurance policies allow you transform them to an entire life insurance plan, so you do not shed insurance coverage. Normally, term life insurance policy policy premium repayments (what you pay monthly or year right into your plan) are not secured in at the time of acquisition, so every 5 or 10 years you own the policy, your premiums could rise.

They likewise have a tendency to be less expensive general than entire life, unless you buy a whole life insurance plan when you're young. There are likewise a few variants on term life insurance policy. One, called group term life insurance policy, is usual amongst insurance policy alternatives you could have accessibility to via your company.

The 9-Minute Rule for Hsmb Advisory Llc

This is typically done at no cost to the employee, with the capacity to buy additional coverage that's obtained of the worker's paycheck. Another variation that you might have access to via your employer is supplemental life insurance policy (Health Insurance). Supplemental life insurance policy might include accidental fatality and dismemberment (AD&D) insurance, or funeral insuranceadditional protection that can assist your family in situation something unexpected takes place to you.

Irreversible life insurance policy simply refers to any kind of life insurance policy policy that doesn't end. There are numerous sorts of irreversible life insurancethe most common kinds being entire life insurance policy and universal life insurance policy. Whole life insurance policy is exactly what it sounds like: life insurance Get the facts coverage for your whole life that pays to your beneficiaries when you die.

Report this page